Trump’s reciprocal tariff strategy: what it means for trade

Trump’s reciprocal tariff strategy increases consumer prices and influences international trade relations, impacting key industries such as manufacturing and agriculture, while shaping the future of trade policies through emerging trends and technologies.

Trump’s reciprocal tariff strategy has stirred quite the debate in economic circles. Have you ever wondered how these tariffs actually shape global trade dynamics? Let’s explore their real implications.

Understanding Trump’s tariff strategy

Understanding Trump’s tariff strategy involves examining how it can influence trade relationships around the globe. At its core, this strategy is intended to protect American industries, but it also has significant ripple effects.

The tariffs primarily target countries the U.S. deems unfair in their trade practices. By imposing these tariffs, the goal is to encourage other nations to change their trade behaviors. But how does this really play out?

Key Elements of Tariff Implementation

One key element is the method of implementation. Tariffs can be applied in various ways, including:

- Based on specific products or sectors

- In response to trade surpluses or deficits

- As part of a negotiation strategy

This flexibility allows the administration to tailor the approach as needed while maintaining pressure on other nations.

The second key element is the response from affected countries. Often, nations retaliate with their tariffs, leading to a tit-for-tat situation. This can create uncertainty, impacting businesses and consumers alike.

Impact on American Consumers

It’s important to remember the effects these tariffs have on American consumers. With increased costs on imported goods, prices can rise in domestic markets. For example, items such as electronics and clothing may become more expensive due to these tariffs. This raises a critical question: who ultimately pays the price of these strategies?

The impact varies significantly by sector. Industries that rely on imported components can experience higher production costs, which may lead them to pass on these costs to consumers. On the flip side, some domestic industries may thrive under this strategy, benefiting from reduced competition.

Overall, understanding Trump’s tariff strategy not only involves recognizing its immediate economic goals but also considering its longer-term implications on trade, consumer prices, and international relations.

Impact on international trade relations

The impact on international trade relations is a significant aspect of Trump’s tariff strategy. It reshapes not only how the United States interacts with other countries, but also how allies and competitors perceive America on the global stage.

When tariffs are imposed, other nations often respond with their own trade measures. This can lead to what many call a trade war, creating uncertainty in international markets. As nations retaliate, the interconnectedness of global economies becomes even more apparent.

Effects on Global Alliances

Tariffs can strain or strengthen alliances. Countries that are traditionally allies may find themselves at odds over trade policies. For instance, when the U.S. imposes tariffs on products from a country like Canada, it can create tension between the two nations.

- Allies may alter their trade agreements.

- Joint ventures could be jeopardized.

- Mutual trust may decrease among trading partners.

These dynamics can alter the landscape of international relations, prompting countries to reconsider long-standing partnerships.

Additionally, emerging economies may see this as an opportunity to expand their influence. Countries like China and India might enhance their trading ties with one another, filling the gaps left by traditional powers.

Long-Term Global Economic Effects

The long-term effects of these tariffs can be profound. Economists often discuss how sustained tariffs can lead to greater protectionism worldwide. This shift could stifle innovation and slow economic growth.

Measures of trade balance can also fluctuate. For instance, while certain sectors may benefit from reduced competition, others might suffer due to increased costs of raw materials and components, impacting their ability to compete globally.

Understanding the impact on international trade relations thus requires a thorough analysis of both immediate and long-term effects. The relationships formed or strained during these turbulent times will likely shape future trade agreements and global economic policies.

Key industries affected by tariffs

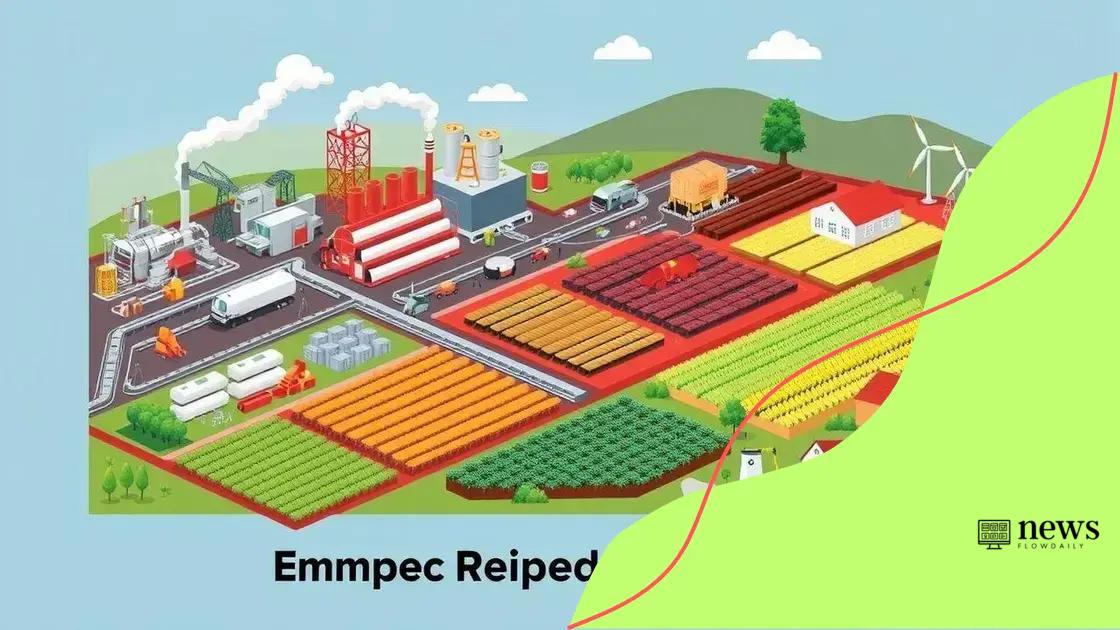

The key industries affected by tariffs are crucial to understanding the broader impact of Trump’s trade strategy. These tariffs can change how industries operate and how consumers respond.

One of the first sectors to notice changes is manufacturing. Particularly, industries that rely on imported materials face immediate cost increases. This can influence prices for consumers as companies pass on these costs.

Manufacturing Sector Impacts

In manufacturing, tariffs tend to focus on heavy machinery and electronics. Companies in these fields may see:

- Increased operational costs due to higher prices of parts.

- Pressure to find domestic suppliers as alternatives.

- Shifts in product pricing, leading to potential drops in sales.

As some manufacturers struggle, others might benefit. Domestic producers could experience increased demand due to less foreign competition.

Agricultural Effects

Agriculture is another key industry impacted by tariffs. Many farmers depend on exports to sustain their businesses. When tariffs are imposed on products like soybeans or corn, it can lead to significant repercussions.

- Exports may decline, impacting farm income.

- Domestic prices may fluctuate based on surplus or scarcity.

- Farmers may have to adapt to new markets for their products.

The tariffs on agricultural goods thus create challenges, not only for producers but also for consumers who may face higher prices at the grocery store.

Additionally, the energy sector also feels the effects. Tariffs on imported oil and gas can lead to increased prices in energy, impacting businesses and households alike. This sector’s response is particularly notable as it intersects with global markets.

Understanding these key industries affected by tariffs sheds light on the numerous ways trade policies can ripple through the economy. The adjustments made by these industries highlight the complexity of navigating tariffs in a globally interconnected economy.

Consumer prices and market reactions

The consumer prices and market reactions to tariffs are vital components of understanding the economic landscape under Trump’s tariff strategy. When tariffs are implemented, they often lead to immediate price changes in various sectors.

As tariffs increase the cost of imported goods, consumers typically see higher prices at the checkout. This effect is particularly noticeable in sectors like electronics, clothing, and food products. For example, if tariffs are placed on imported electronics, shoppers may find that their favorite gadgets now come with a higher price tag.

The Ripple Effect on Prices

When prices rise, it has a cascading effect on consumer behavior. People may begin to:

- Reduce spending on non-essential items.

- Seek cheaper alternatives, often turning to local products.

- Adjust their purchasing habits based on price changes.

This shift in consumer behavior can lead to a decrease in overall market demand, which can further complicate economic recovery for affected industries.

Market reactions can also vary significantly based on consumer sentiment. If consumers feel uncertain about future prices or availability of products, they may choose to save rather than spend, impacting businesses’ sales figures. This change can trigger downward trends in stock prices for companies heavily reliant on consumer spending.

Long-Term Impacts on Inflation

Another critical aspect of consumer prices is its relationship with inflation. Sustained increases in consumer prices can lead to broader inflationary pressures. This inflation can affect the purchasing power of consumers, reducing the overall economic growth.

Economists closely monitor these trends to understand the overall health of the economy. If inflation rises too quickly, central banks may be prompted to raise interest rates, which can slow down investment and spending further.

In conclusion, the relationship between consumer prices and market reactions highlights the complexity of economic dynamics influenced by tariffs. Everyday consumers feel the impact directly, and their responses can shape market trends and economic policies moving forward.

Looking ahead: the future of trade policies

Looking ahead, the future of trade policies is uncertain yet exciting. The shifts in tariffs and trade agreements are continuing to evolve as global dynamics change. Countries around the world are watching closely, as the decisions made today will shape economic landscapes for years to come.

A major factor in determining future policies is the reaction of other countries. If nations choose to retaliate with their tariffs, we could see a cycle of escalations. This dynamic can lead to increased friction between trading partners. Trade negotiations are becoming more cautious as countries reassess their positions and dependencies.

Emerging Trends in Trade Agreements

In this evolving landscape, there are a few key trends to watch:

- Increased focus on regional trade agreements that bypass larger global treaties.

- More scrutiny of trade practices that are deemed unfair or predatory.

- The rise of digital trade policies that address e-commerce and technology exchanges.

These trends could provide new frameworks for cooperation, moving beyond traditional trade barriers.

Additionally, environmental concerns are becoming a significant part of trade discussions. As global awareness of climate change rises, many countries are exploring sustainable trade practices. Policymakers may prioritize agreements that support green technologies and sustainable industry practices.

The Role of Technology

Technology also plays a critical role in shaping the future of trade policies. Innovative technologies like blockchain and artificial intelligence could enhance transparency in trade. This can help address issues like fraud and ensure compliance with trade agreements.

As these technologies develop, we may see a shift toward more efficient trade logistics. Cost reductions and faster transportation methods could make international trade more accessible to smaller businesses.

Overall, the future holds both challenges and opportunities. Monitoring the trends in trade policies will be essential for businesses and governments alike. Proactive engagement and adaptability will likely determine who thrives in the new trade environment.

FAQ – Frequently Asked Questions about Trump’s Tariff Strategy

What are reciprocal tariffs?

Reciprocal tariffs are taxes imposed by one country on goods imported from another as a response to similar tariffs imposed by that country.

How do tariffs affect consumer prices?

Tariffs can lead to increased costs for imported goods, which often results in higher prices for consumers in the marketplace.

Which industries are most impacted by tariffs?

Key industries affected by tariffs include manufacturing, agriculture, and energy sectors, all of which rely on global supply chains.

What trends should we watch for in future trade policies?

Future trade policies may focus on regional agreements, technology integration, and sustainable practices as nations adapt to new economic realities.